EAST LANSING, MI— On December 3, the Reseda group, a service organization of MSU Federal Credit Union (MSUFCU), announced its partnership with the first decision-making app designed to help people with developmental and intellectual disabilities in their daily lives.

“We partnered with LetMeDoIt because it is an opportunity to promote financial inclusion in an underserved community,” said Ben Maxim, Chief Technology Officer at MSUFCU, to El Central. “This app is not just for those with disabilities but also for their caregivers and family who support them.”

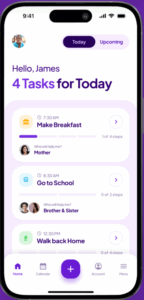

Created in 2023 by Angad Sahgal and his father, Amit Sahgal, LetMeDoIt is the first app of its kind to provide accessibility and inclusion, leveraging a “supported decision-making platform”, according to their web page.

For Jacqueline Cuevas, chair of Self Advocates of Michigan, dignity is what matters, and this app halts the tokenization that people with Intellectual and Developmental Disabilities (IDD) face in societies that ignore them. “People with IDD are functioning members of society, contributing to families, workplaces, and communities,”Cuevas said. “We deserve systems that reflect trust, respect, and inclusion.”

The app makes its users’ lives easier. It is designed to provide tools for managing finances, healthcare, employment, and resource access, and transforms the most complicated choices into simple ones. Additionally, it promotes its users’ autonomy while keeping caregivers and family informed about their situation.

For Sahgal, the creation of the app was personal. He is a senior student at Georgia State University under the Inclusive Digital Expression and Literacy (IDEAL) program. “As a person with a disability, entrepreneurship has allowed me to pursue my dreams and pave the way for the next generation of disabled entrepreneurs,” Angad Sahgal said when the app was launched. “I know what it means to work with limitations and turn them into opportunities.”

Since its launch and due to the importance of the initiative, the Atlanta-based project has been funded and supported by several funding programs, like Synergies Work and the Main Street Entrepreneurs Seed Fund from Georgia. The partnership with MSUFCU aims to provide financial education and banking products that users need most.

Following the Reseda group, they are committed to financial inclusion in what they call a “redefinition of what inclusion looks like in financial services.” The credit union service organization has invested in other financial applications such as Goalsetter and Tamdem, promoting financial education and organization in the community.

“There is a trend in the financial services industry where banking is moving beyond just the actual banking products and transactions, and it is being supportive of embedded finance or lifestyle activities that banking facilitates,” said Maxim.

Organizing self-finances may be tricky for many people most of the time. Cuevas affirms that for people with IDD, it is an overwhelming story. Factors such as background of trauma, lack of financial education, or cognitive overload merge with frequently complicated financial systems.

“When decisions are taken away ‘for safety,’ people lose opportunities to learn, grow, and build confidence,” Cuevas says. “Over time, this can lead to financial dependence, vulnerability to exploitation, and a lack of trust in one’s own decision-making.”

According to the latest state data, there are approximately 2.3 million people with disabilities in Michigan. Following the latest “ALICE In Focus” report, 48% of this group live below the minimum income level needed to afford housing, childcare, healthcare, transportation, and a smartphone plan. 24,923 are identified as Hispanic.

Maxim is hopeful that job opportunities will come to people with disabilities, as an advantage that the application will bring. He mentions that using the app will expand users’ abilities to have jobs they are not frequently offered. “By allowing them to live on their own and by promoting financial literacy with this group, they will be able to live independently.

“Financial empowerment comes from being included in decisions, not removed from them,” added Cueva. She highlights how important it is to have systems that support people with disabilities when they need a hand.

“As a disabled person, I know that my ability to process information changes when I am overstimulated or triggered,” she finished. “That doesn’t mean I shouldn’t manage my finances — it means I need systems that support me during those moments.”

******

Erick Diaz Veliz is a Peruvian reporter based in Lansing, Michigan. He has documents and reports on cultural, social, and political issues in Peru and Michigan as a freelancer. Erick was born in Lima, Peru, and has been living in Lansing since 2018.

This article was made possible thanks to a generous grant to EL CENTRAL Hispanic News by Press Forward, the national movement to strengthen communities by reinvigorating local news. Learn more at www.pressforward.news