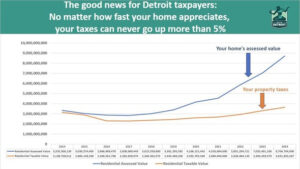

On Monday, January 22, Detroit Mayor Mike Duggan announced that Detroit homeowners gained a record $1.7 billion in wealth in 2023 from the appreciation of value of their houses. Every residential neighborhood in the city of Detroit saw an increase.

Based on home sales data from the past two years, homeowners saw an average increase of 23% over 2022. That rise in value will be reflected in an annual notice of proposed property assessment changes for 2024, which will begin arriving in mailboxes this week. The actual property tax increase is capped by 5% by the Michigan Constitution, unless the home was sold in the last year. When a home sells, the cap is lifted, and the taxable amount adjusts to the State Equalized Value the year following the transfer.

Historic Increase in Value

The rise in residential property value in the past year was so significant that the value of all residential property in Detroit grew by $1.7 billion compared to last year, the largest single- year increase on record. Earlier this month, it was reported nationally that Detroit had surpassed Miami as the city with the highest appreciation of home values, based on an annual study released by CoreLogic.

The average Detroit homeowner has seen their property values more

than triple since 2017. Detroit homeowners’ value grew from $2.8 billion to $8.7 billion in that time:

Total value of all Detroit residential property

2017 – $2.8 billion

2018 – $3.0 billion

2019 – $3.4 billion

2020 – $4.2 billon

2021 – $4.5 billion

2022 – $5.9 billon

2023 – $7.0 billon

2024 – $8.7 billon

“We have had some tough times in Detroit. I am really pleased that the homeowners who stayed have been rewarded,” said Mayor Duggan.

Market sales determine assessed value

To determine this year’s assessment, the city examined over 13,100 market sales across two years (April 1, 2021, through March 31, 2023) to compute the proposed 2024 Assessments. The Office of the Assessor also reviews aerial and street level imagery of properties to determine valuation. Below is a breakdown of this year’s assessed residential value changes across the city’s 209 neighborhoods:

- 3 out of 209 neighborhoods (1%) had an increase in value over 50%

- 48 out of 209 neighborhoods (23%) had an increase in value ranging from 30% to 49%

- 140 out of 209 neighborhoods (67%) had an increase in value ranging from 15% to 29%

- 7 out of 209 neighborhoods (3%) had an increase in value ranging from 10% to 15%

- 9 out of 209 neighborhoods (4%) had an increase in value ranging from 5% to 9%

- 2 out of 209 neighborhoods (1%) had an increase in value ranging from 0.01% to 1%

“The increased home value in every neighborhood is significant as it provides greater stability not only for neighborhoods but also for the City’s financial outlook,” said Chief Financial Officer, Jay Rising.

NEW: Property owners to receive revamped proposed assessment notices

Notices have been mailed to the City’s over 408,000 residential, commercial, industrial, and personal property owners, advising them of their proposed assessments for 2024. These are not tax bills. Actual bills will be mailed out

at the end of June (summer) and November (winter) by the City of Detroit’s Office of the Treasury.

New this year are revamped assessment notices that are in accordance with the Property Tax Reform ordinance passed by City Council last year. Notices are in larger print and have much more information about the assessment appeals process.

Deadline for assessment appeals extended

Under State law, property owners have the right to appeal the proposed changes. The proposed 2024 Assessments are tentative until the completion of the local review period in March and any possible changes from the Wayne County Assessment and Equalization Department in April.

Residents will have three weeks to appeal all assessments; the City of Detroit has permanently extended the Assessor Review from February 1st through February 22nd, Monday through Saturday.

The Assessors Review appeal process encourages all property owners to take advantage of their right to question how their property is valued during this time.

How to file an appeal

Anyone with questions regarding their assessment, may email the Assessor’s office

at AsktheAssessor@detroitmi.gov. Appeals can be submitted online, by letter, or in person. Property owners can also submit their appeal in person Monday-Thursday, 8:00a.m. to 4:30 p.m. at the Coleman A. Young Municipal Center, in the Detroit Taxpayer Service Center Suite 130. Anyone wishing to address the Office of the Assessor in person will have the opportunity to do so via teleconferencing or by appointment.

To file an appeal online, visit www.detroitmi.gov/PropertyTaxAppeal (available

February 1 through 22nd by 4:30 p.m.). To file an appeal by mail (must be postmarked to the Office of the Assessor by February 22, 2024) send to: City of Detroit, Office of the Assessor – ABOR, 2 Woodward Ave Suite 804, Detroit, MI 48226

The City of Detroit March Board of Review begins March 6th and ends March 23rd. Any property owner or their agent who wishes to present to the Detroit Board of Review will have that opportunity.

A completed petition to the March Board of Review must be filed by March 11, 2024, 4:30 p.m. to schedule a hearing. Teleconferencing is encouraged.

Commercial, Industrial, and Personal Property owners may, appeal to the March

Board of Review, or if they chose, proceed directly to the Michigan Tax Tribunal. The deadline to appeal directly to the Michigan Tax Tribunal is May 31st.

Help with property taxes for those in need

Through the Homeowners Property Tax Exemption (HOPE) program, homeowners can qualify for 10%, 25%, 50%, 75%, or a 100% reduction in property taxes, depending on household income. The deadline to apply is November 1, 2024. For more information on HOPE, go to www.detroitmi.gov/HOPE.