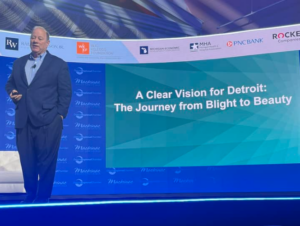

MACKINAC ISLAND – Mich. – Mayor Mike Duggan unveiled a sweeping new proposal that would transform the city’s broken property tax system, which currently rewards owners of vacant and blighted properties while placing a heavy tax burden on homeowners. The Mayor’s Land Value Tax Plan would bring much-needed tax relief to homeowners and most businesses, while making owners of blighted and vacant properties pay their fair share.

Detroit’s current tax structure is the biggest obstacle in the city’s ongoing transition from Blight to Beauty. Under the current system, vacant land and blighted buildings are taxed at a much lower rate than single-family homes and other structures. “We have a property tax system that punishes anyone that builds in Detroit and strongly rewards anyone who owns vacant land and completely neglects it,” Detroit Mayor Mike Duggan said. “Our land has value and it’s time we tax it that way and stop incentivizing blight.”

The system is so broken that one speculator in Detroit owns 261 parcels of vacant land totaling 22 acres across the entire city and only pays $6,542 in taxes while a single Detroit homeowner with a $200,000 house who puts time and energy into maintaining their property pays $6,800 in taxes.

Under the Mayor’s proposed Land Value Tax Plan, cities like Detroit would have the ability to increase the tax millage on land and reduce the tax millage on structures like homes and buildings. That means property taxes on land will go up while the taxes on structures like homes and buildings would go down. It applies to every neighborhood, requires no application, and does not ever expire.

Detroit’s current millage rate of 86 on all properties is far higher than surrounding cities. The Land Value Tax Plan proposes to replace 20 mills for city operations and 6 mills of the State Education Tax with the new Land Value Tax. The increase in tax rates for land speculators and others who are not using Detroit land efficiently would make up the revenue needed to keep city operations within a balanced budget. Reducing the effective tax rate for residents and business owners will mean Detroit’s tax rate is comparable to surrounding cities and bring more growth and investment.

Homeowners

Homeowners are the biggest winners under the Land Value Tax Plan. Ninety-seven percent of Detroit homeowners would see a reduction in their property taxes while the remaining 3% would see no change at all. The Land Value Tax Plan provides more relief than the NEZ Homestead exemption. The median homeowner will save 27% on their tax bills. The average $50,000 home in Detroit will see a $450 tax cut, while a $100,000 home will see a tax cut of $900.

Small Businesses

Under the Mayor’s Land Value Tax Plan, 70% of small businesses can expect to see a reduction in their property taxes. A typical retail business will see 5% in savings, while others may see an increase based on the size of their parking lot and the location of their business. While the Land Value Tax Plan will increase taxes on vacant, unproductive land, the City of Detroit is working on a plan to protect existing businesses and developments through a tax credit system. Properties that meet a certain development threshold will be capped at a maximum increase, and businesses that meet zoning requirements for parking will be protected from increases on those parking spaces.

New and Expanded Developments

The land value tax plan will also make building, rehabbing, and expanding multifamily housing more affordable. Multifamily housing will benefit from a median savings of 20%. New housing developments will be easier to finance and less expensive to operate. The tax savings will help spur more high-quality, affordable housing throughout Detroit.

Next Steps

Mayor Duggan will begin working with stakeholders as the community leaders, housing advocates and other stakeholders as the Land Value Tax Plan heads to the Michigan Legislature for approval. Once approved by the legislature, municipalities like Detroit would have the option of enacting it with the approval of residents. It is anticipated that the Land Value Tax Plan would be on the Detroit ballot next February. If approved, the Land Value Tax Plan would be phased in over three years beginning in 2025.

To learn more about the plan, visit https://detroitmi.gov/departments/office-chief-financial-officer/land-value-tax-plan.